Section 125

What is Section 125?

On November 6, 1978, Section 125 was added to the Internal Revenue Code. Congress passed the Revenue Act of 1978, and the Cafeteria Plan was born. Cafeteria plans existed before 1978, but employer contributions were taxable to employees. Section 125 of the Code allows employees to pay for health insurance and other group benefits with pre-tax salary deductions. This added up to significant savings.

Timeline

1978

Section 125 plans

introduced to

allow for health

benefits on a

Pretax basis.

2010

Affordable Care

Act launched to

improve access to

health coverage

for individuals

nationally.

2014

Wellness benefits

added to the ACA

allowing for the

payment of specific

wellness program

activities.

2018

Section 125

Indemnity benefit

plans become fully

insured products

by major insurance

carriers.

2020

QHB Launches its

fully insured plan

and receives State

approvals

nationally.

What is Quantum Health Benefits?

Quantum Health Benefits is a Fully-Insured Healthcare Management Program that falls under Section 125.

The Quantum Program does not disrupt, change, or replace any of your current benefits.

The Plan is designed to ENHANCE the employer’s current benefits program and increase take-home pay for employees.

The Plan can be implemented at any

time during the calendar year.

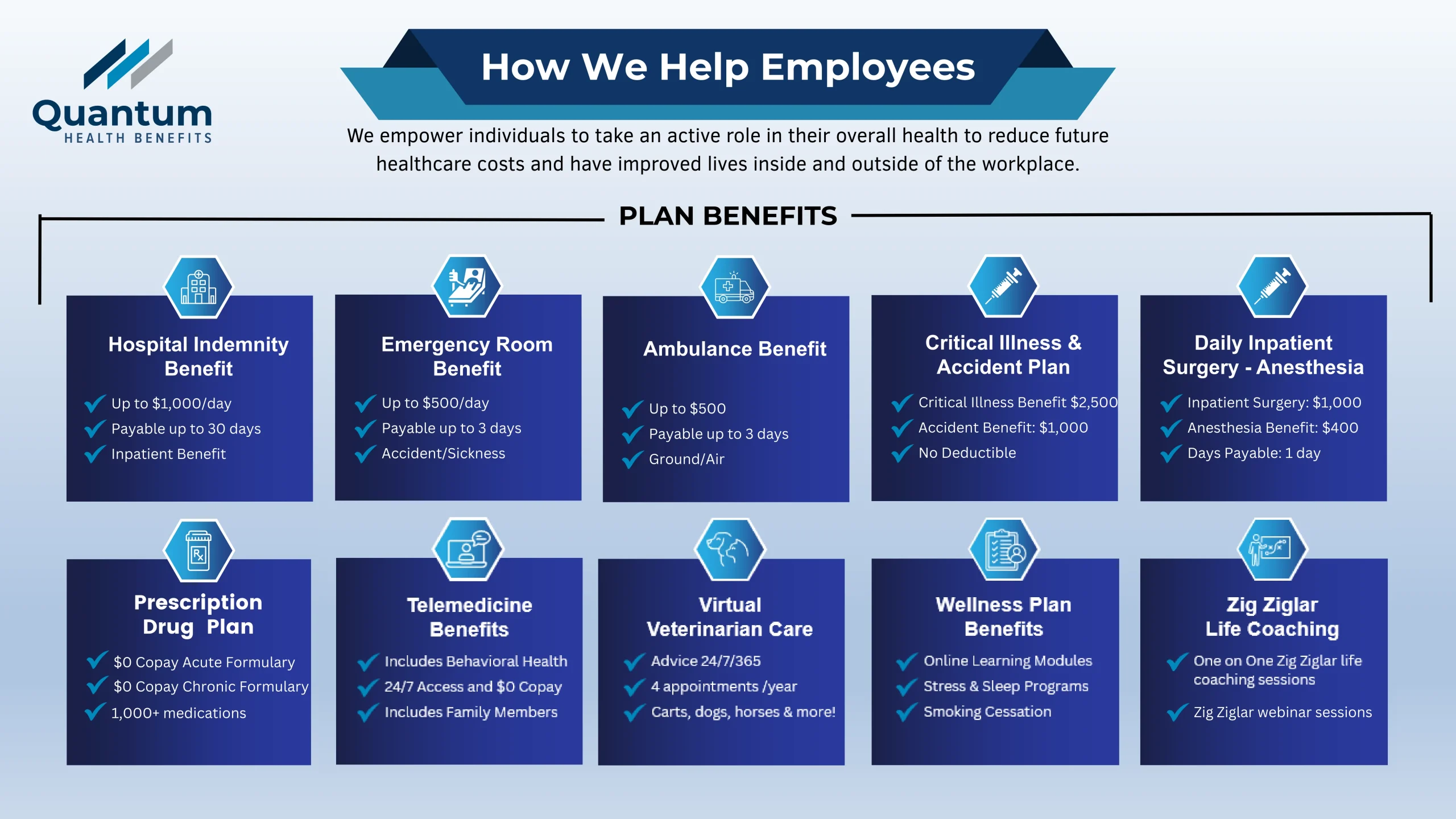

Quantum Health Benefits is an all-inclusive preventive healthcare management program designed to reduce healthcare costs and improve employee productivity.

With no out-of-pocket costs, Quantum Health Benefits prioritizes and incentivizes preventive healthcare for employees while benefiting employers through tax savings.

With NO cost to the employee and $600 to $900 savings annually per employee to the employer.

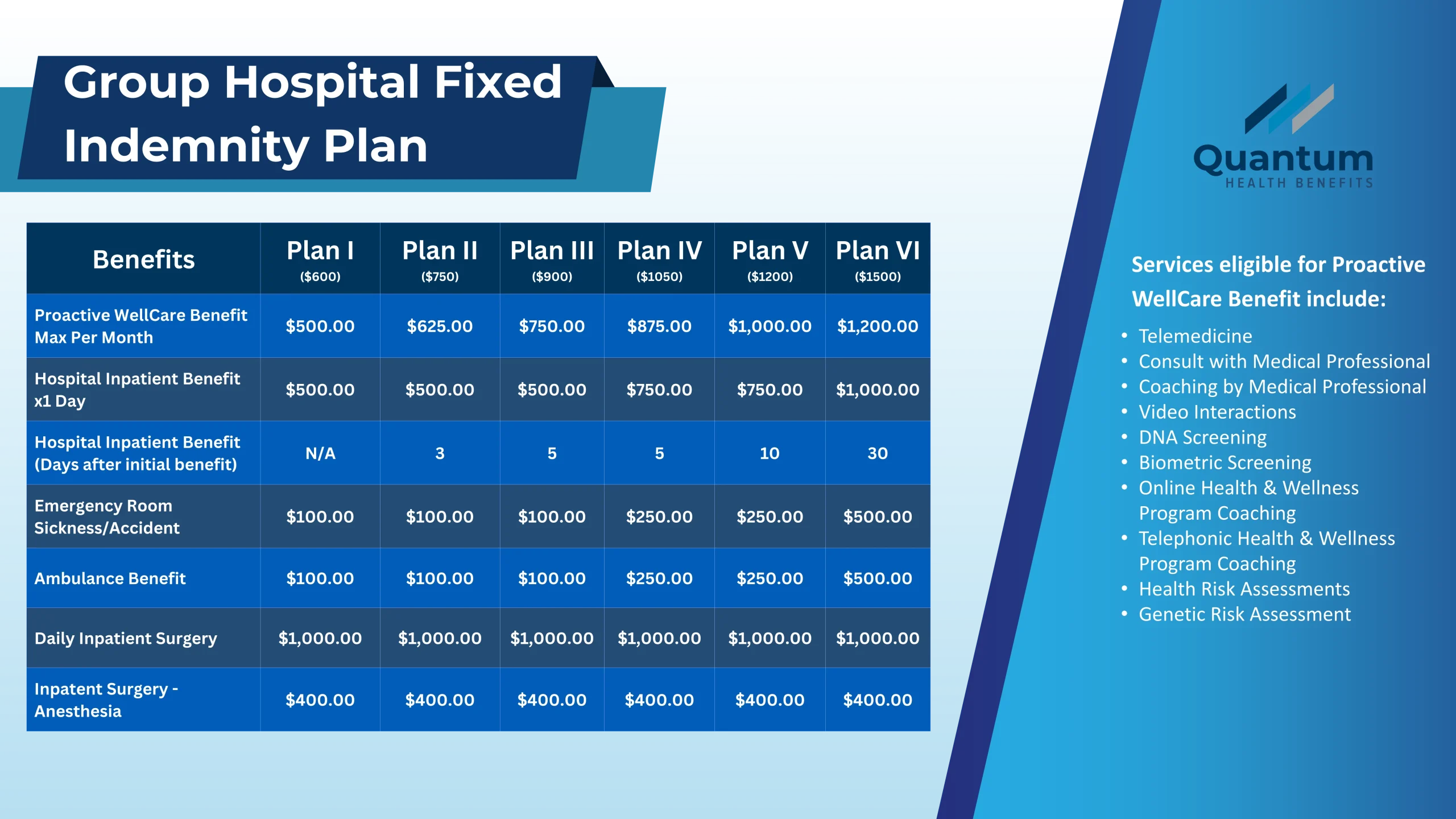

The QHB Plan is a Fully Insured Supplemental Indemnity Plan.

The QHB Plan is approved by the State departments of insurance and available in all 50 states.

The QHB Plan is underwritten and fully insured through major US insurance carriers.

How It Works

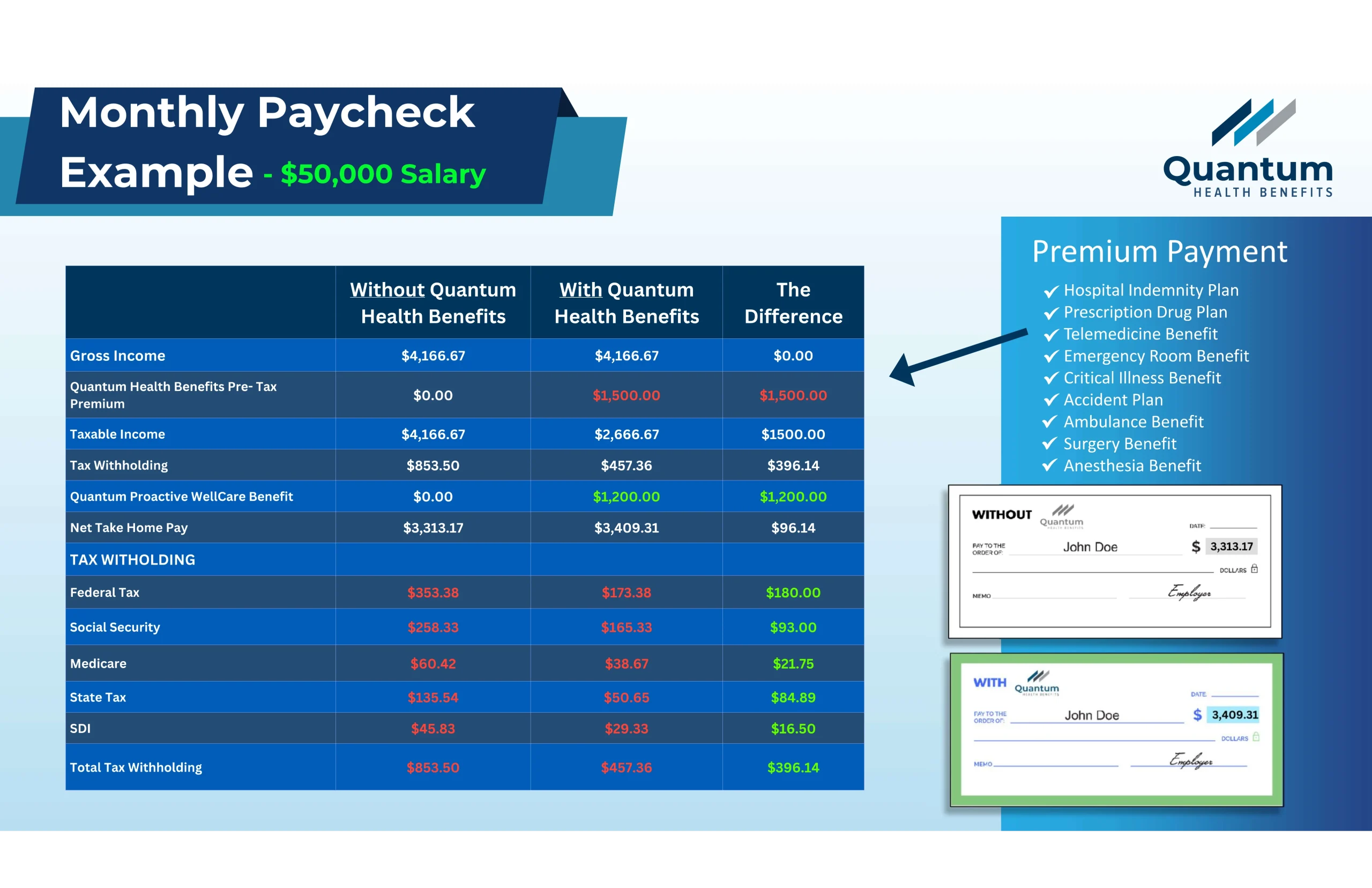

A premium is deducted from the employee’s paycheck through a Section 125 Cafeteria Plan.

This deduction is the Insurance premium for a Fully Insured Indemnity Insurance Plan

This deduction lowers the employee’s taxable income creating a tax savings for both employee and employer.

The Employee adopts healthy lifestyle changes through access to the Quantum Proactive WellCare Plan Benefit.

Their participation generates a Section 125 Cafeteria Plan claim paid directly from the insurance company into their paycheck.

How Does Quantum Health Benefits Help Employers?

Profitability

There are several ways Quantum

Health Benefits improves a company’s

profitability. First, the Quantum Health

Benefits Plan is paid for with pre-tax

dollars which saves the employer an

average of $600-$900/year per

participant. Secondly, happy and

healthy employees mean improved

productivity and decreased

absenteeism.

Financial

Most major medical plans have

substantial out-of-pocket expenses

from deductibles, copays, coinsurance

and prescription drug costs. We

provide each employee a suite of

benefits designed to address these

issues and lessen the financial burden

on both the employer and employee.

Wellness

The Quantum Health Benefits Plan

improves overall health and wellness

through a few simple monthly

activities. These activities include selfdirected courses, health quizzes,

HealthWallet health risk assessment,

health scores and risk identification.

Employer Savings per 100 Employees

$60k – $90k Annual Savings Per Year

$300k-$450k 5 Yr EBITDA (Earnings Before Interest, Taxes, Depreciation & Amortization)

Next Steps

Run A Payroll Census

This will illustrate the company savings, increases in employee take-home pay and employee benefits..

Execute the RFC and MSA

Once these documents are signed, we can start the implementation process..

Implementation process

We meet with your Human Resource and Payroll departments to coordinate the execution and

administration of the Quantum Health Benefits Plan.

Enrollment

Quantum Health’s enrollment representatives are available to discuss with each employee the benefits of the Quantum

Health Benefits Plan, how to enroll in the Proactive WellCare App, how to file an insurance claim, and

answer any questions that employees may have.

Let Us Help You Get Started Today!

Contact Gesla Insurance Agency now to speak with our expert advisors and find the perfect coverage for your needs.